NRI Investment App – Your Gateway to Indian Markets

When using NRI investment app, a digital platform that lets Non‑Resident Indians buy and manage Indian financial products from abroad. Also known as NRI trading app, it combines mobile convenience with compliance tools.

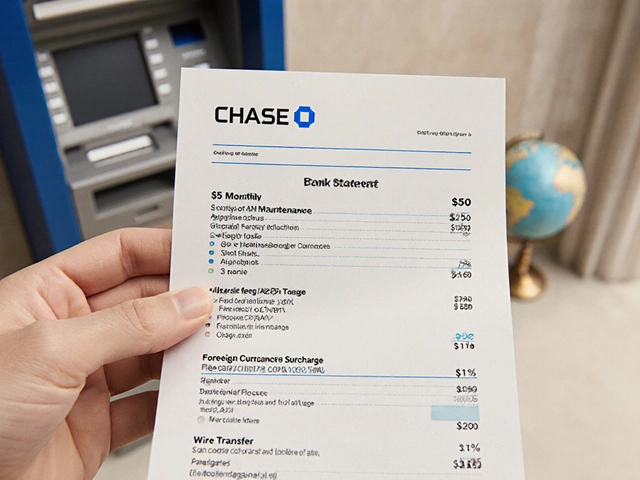

These apps typically host mutual funds, pooled investment vehicles that let NRIs diversify across stocks, bonds, and other assets, providing a simple entry point to Indian equity and debt markets. The cash engine behind every transaction is the NRE account, a repatriable savings account that holds foreign currency and converts it to INR when needed. Before you can trade, the app guides you through the KYC process, a regulatory check that verifies identity, address and tax residency for Indian financial services. Together these pieces create a seamless experience for NRIs looking to grow wealth in India.

Why Choose an NRI Investment App?

NRI investment app brings three core attributes to the table: platform type, feature set, and target user profile. The platform type includes native mobile apps for iOS and Android as well as responsive web portals, giving you access whether you’re on a smartphone or a laptop. Feature‑set values are real‑time portfolio tracking, instant USD‑to‑INR conversion, built‑in tax calculators, and push notifications for corporate actions. The target user profile is the NRI investor who needs repatriable funds, low‑cost entry into Indian securities, and compliance with FATCA and Indian tax rules. In practice, the app enables real‑time tracking of a diversified mutual‑fund basket, requires KYC compliance before any trade, and lets you file annual tax statements directly through the dashboard.

Taxation influences every decision you make on the app. Indian tax law treats earnings from mutual funds, dividends, and capital gains differently for NRIs, and the app’s built‑in calculator shows the after‑tax return for each investment. The NRE account supports repatriation, meaning you can move profits back to your foreign bank without additional withholding tax, as long as you follow the declared limits. Security is another pillar: most apps use two‑factor authentication, end‑to‑end encryption, and are regulated by SEBI, which builds trust for overseas investors.

Choosing the right app boils down to fees, ease of use, and the range of products offered. Look for transparent brokerage charges, a clear KYC workflow, and a support team that understands NRI-specific queries. In the sections below you’ll find detailed reviews, step‑by‑step onboarding guides, and expert tips that cover everything from opening an NRE account to filing your Indian tax return. Whether you’re a first‑time investor or managing a sizable portfolio, the articles ahead will help you pick the best tool and make informed decisions.

Best App for NRI Investment in Indian Mutual Funds

Investing in Indian mutual funds as an NRI can be a strategic financial move. The right app can make this process seamless, offering user-friendly interfaces and robust features for effective fund management. Discover the best app options available, understand the tax implications, and explore expert tips for maximizing your investment potential. This guide aims to empower NRIs with the knowledge to make informed decisions in the Indian mutual fund market.

View More