GST Calculator: Exclusive & Inclusive Prices

Calculate GST amounts for Australian business transactions. Enter either a GST-exclusive or GST-inclusive price and get the other value plus GST amount with step-by-step calculation.

Ever stared at a price tag and wondered how much of it is actually GST? Or tried to work out the GST you owe and got lost in the numbers? You’re not alone. In Australia, the GST formula is the backbone of every tax invoice, every Business Activity Statement (BAS), and every small‑business owner’s spreadsheet. This guide breaks it down in plain English, shows you step‑by‑step calculations, and gives you quick tips to avoid common mistakes.

What is GST?

GST is a broad‑based consumption tax of 10% applied to most goods and services sold or consumed in Australia. It’s collected by businesses on behalf of the Australian Taxation Office (Australian Taxation Office, or ATO) and remitted through the BAS each quarter.

Understanding the GST Rate

The standard GST rate is 10%, which means for every dollar of taxable supply, ten cents is GST. The rate hasn’t changed since it was introduced in 2000, so you can safely use it for every calculation unless you’re dealing with GST‑free items like fresh food or health services.

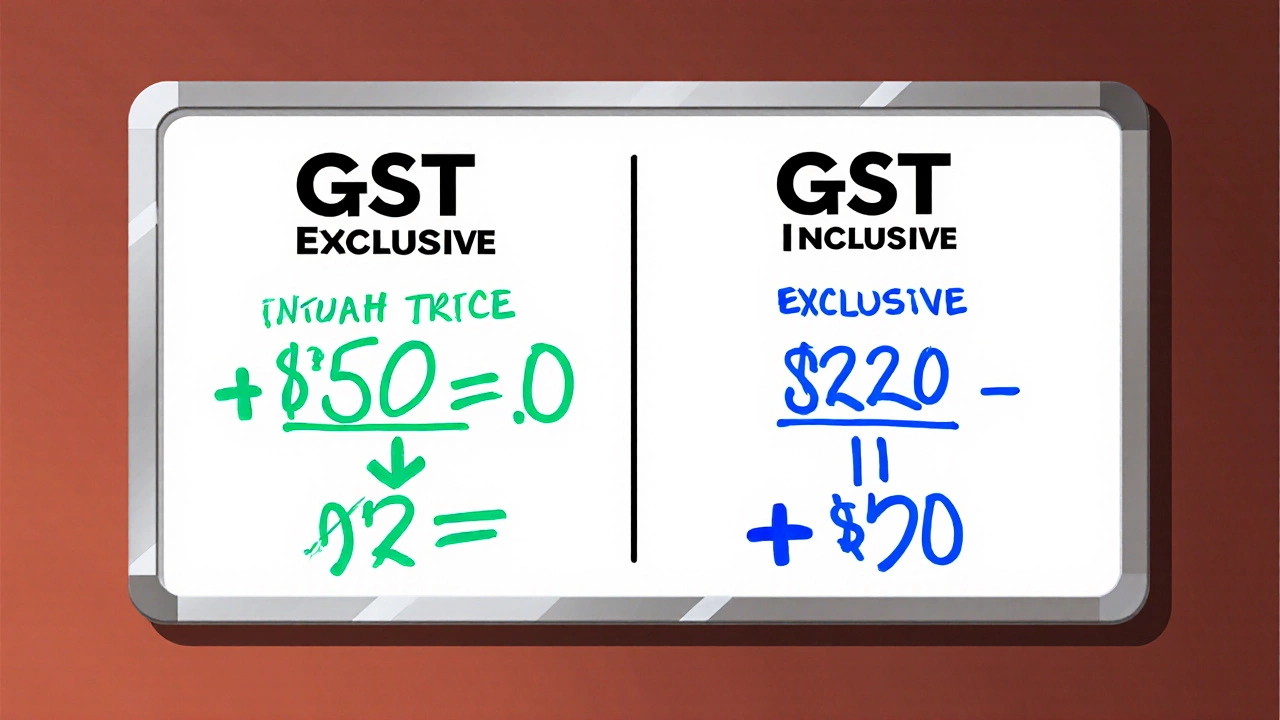

GST‑Exclusive vs. GST‑Inclusive Prices

Before you plug numbers into any formula, decide whether the price you have is GST‑exclusive (the price before tax) or GST‑inclusive (the price after tax). The two approaches lead to slightly different equations:

- GST‑exclusive price + GST = GST‑inclusive price

- GST‑inclusive price ÷ 1.10 = GST‑exclusive price

Getting this straight saves you from adding tax twice or under‑charging your customers.

The GST Formula - Step by Step

Here’s the core formula you’ll use over and over:

- Identify the base amount (either GST‑exclusive or GST‑inclusive).

- If you have a GST‑exclusive amount, multiply it by the GST rate (10%) to get the GST payable.

GST = Base × 0.10 - If you have a GST‑inclusive amount, divide it by 11 and then multiply by 10 to extract the GST.

GST = (Inclusive ÷ 11) × 10 - To find the GST‑exclusive price from an inclusive figure, divide the inclusive amount by 1.10.

Exclusive = Inclusive ÷ 1.10 - To get the GST‑inclusive price from an exclusive figure, add the GST you just calculated.

Inclusive = Exclusive + GST

That’s the whole story-just pick the right starting point.

Real‑World Examples

Let’s walk through a few scenarios you might encounter.

Example 1: Calculating GST from a GST‑Exclusive Price

You sell a kitchen gadget for $150 (exclusive of GST). What do you charge the customer?

- GST = 150 × 0.10 = $15

- GST‑inclusive price = 150 + 15 = $165

So the invoice should show $165 total, with $15 listed as GST.

Example 2: Extracting GST from a GST‑Inclusive Price

A client pays you $220 for a consulting service, and the amount already includes GST. How much of that is GST?

- GST = (220 ÷ 11) × 10 = $20

- GST‑exclusive amount = 220 ÷ 1.10 = $200

You would record $200 as the taxable supply and $20 as the GST collected.

Example 3: Using the Formula for Multiple Items

Imagine you sell three products:

- Item A: $45 (exclusive)

- Item B: $80 (inclusive)

- Item C: $120 (exclusive)

Calculate total GST:

- Item A GST = 45 × 0.10 = $4.50

- Item B GST = (80 ÷ 11) × 10 ≈ $7.27

- Item C GST = 120 × 0.10 = $12.00

- Total GST = $4.50 + $7.27 + $12.00 ≈ $23.77

Round to two decimal places if your accounting software does not do it automatically.

Applying the GST Formula in Your BAS

When it’s time to lodge the Business Activity Statement, you’ll need two key numbers:

- GST payable - the total GST you collected from sales.

- GST credits - the GST you paid on business purchases (input tax credits).

Subtract credits from payable to get the net amount you owe or get back.

Here’s a quick flow:

- Use the GST formula to calculate GST on every taxable sale. Add them up - that’s your GST payable.

- For each purchase, apply the same formula to the purchase price (if you have a GST‑inclusive receipt) to find the GST credit.

- Enter the totals in the BAS under G1 (GST on sales) and G11 (GST on purchases).

- Net = G1 - G11. File by the due date to avoid penalties.

Common Pitfalls and Pro Tips

- Don’t mix exclusive and inclusive prices. Always standardise before applying the formula.

- Watch out for rounding. The ATO expects amounts rounded to the nearest cent. Consistent rounding prevents mismatched totals.

- Remember GST‑free items. Food, education, and medical services are exempt - they don’t trigger the formula.

- Keep good records. A valid tax invoice must show the GST amount, your ABN, and the price before tax.

- Use accounting software. Most tools (Xero, QuickBooks, MYOB) have built‑in GST calculations - just verify the settings.

Quick Checklist Before You File

- Identify whether each transaction is GST‑exclusive or GST‑inclusive.

- Apply the correct GST formula to every sale and purchase.

- Round all GST amounts to two decimal places.

- Separate GST‑free items - they don’t belong in the calculation.

- Summarise G1 (GST on sales) and G11 (GST on purchases) on your BAS.

- Double‑check that your tax invoice includes: ABN, GST amount, price before tax, and clear description.

Comparison Table: GST‑Exclusive vs. GST‑Inclusive Pricing

| Aspect | GST‑Exclusive | GST‑Inclusive |

|---|---|---|

| How price is shown | Base price only (e.g., $100) | Total price including GST (e.g., $110) |

| GST calculation | Multiply by 0.10 | Divide by 11, then multiply by 10 |

| Typical use | Wholesale, B2B quotes | Retail signage, online listings |

| Impact on customer | Customer adds GST at checkout | Customer sees final cost up front |

Frequently Asked Questions

What is the GST rate in Australia?

The standard Goods and Services Tax (GST) rate is 10% of the taxable value of most goods and services.

How do I calculate GST if the price I have includes GST?

Divide the GST‑inclusive amount by 11 and then multiply by 10. For example, $220 ÷ 11 = $20, then $20 × 10 ÷ 10 = $20 GST, leaving $200 as the GST‑exclusive amount.

Can I claim GST credits on my purchases?

Yes, if you’re registered for GST and the purchase was for a taxable supply, you can claim the GST paid as an input tax credit on your BAS.

What items are GST‑free?

Common GST‑free categories include basic food, most education services, health services, and some charitable activities.

Do I need to use the GST formula for every transaction?

If the transaction is taxable and you’re recording it for BAS, yes. For GST‑free items you can skip the calculation.

Write a comment