Online Banking: Your Fast Track to Smarter Money Management

When working with Online Banking, the ability to handle transactions, check balances, and manage accounts through a web portal or mobile app. Also known as e‑banking, it lets you skip the branch line and control finances from anywhere. Online Banking encompasses digital payments, integrates with budgeting tools, and relies on secure authentication. This ecosystem means you can move money, pay bills, or even open new accounts without stepping foot inside a bank.

Key Players and Concepts Shaping the Digital Finance Landscape

One of the core Digital Payments, methods like UPI, wallets, and card‑based transfers that let you pay online instantly, is tightly linked to online banking. Digital Payments requires robust encryption and two‑factor verification, which directly impacts the safety of your Internet Banking, the web‑based interface many banks provide for everyday transactions. When you log into your internet banking portal, the system checks your credentials and then hands off the payment request to the digital payment network. For Non‑Resident Indians, NRI Banking, services that let overseas Indians open and manage Indian accounts remotely, adds another layer. NRI Banking relies on cross‑border fund transfers, which are facilitated by the same digital payment infrastructure. It also means you must watch the Bank Charges, fees for transactions, maintenance, and foreign exchange that can eat into savings. Understanding how bank charges influence your choice of platform helps you avoid hidden costs and pick a service that aligns with your spending habits. These entities intertwine: online banking includes internet banking portals; internet banking uses digital payments to move money; digital payments are affected by bank charges; and NRI banking depends on both internet banking and digital payments to work smoothly. Together they shape the user experience, security posture, and overall cost of managing money digitally in India.

Below you’ll find a curated mix of articles that break down each piece of this puzzle. From comparing major banks’ fee structures to walking you through setting up an internet banking account, the posts cover beginner tips, advanced NRI strategies, and safety checks for every payment method. Dive in to see practical steps, real‑world examples, and the latest trends that will help you make the most of online banking today.

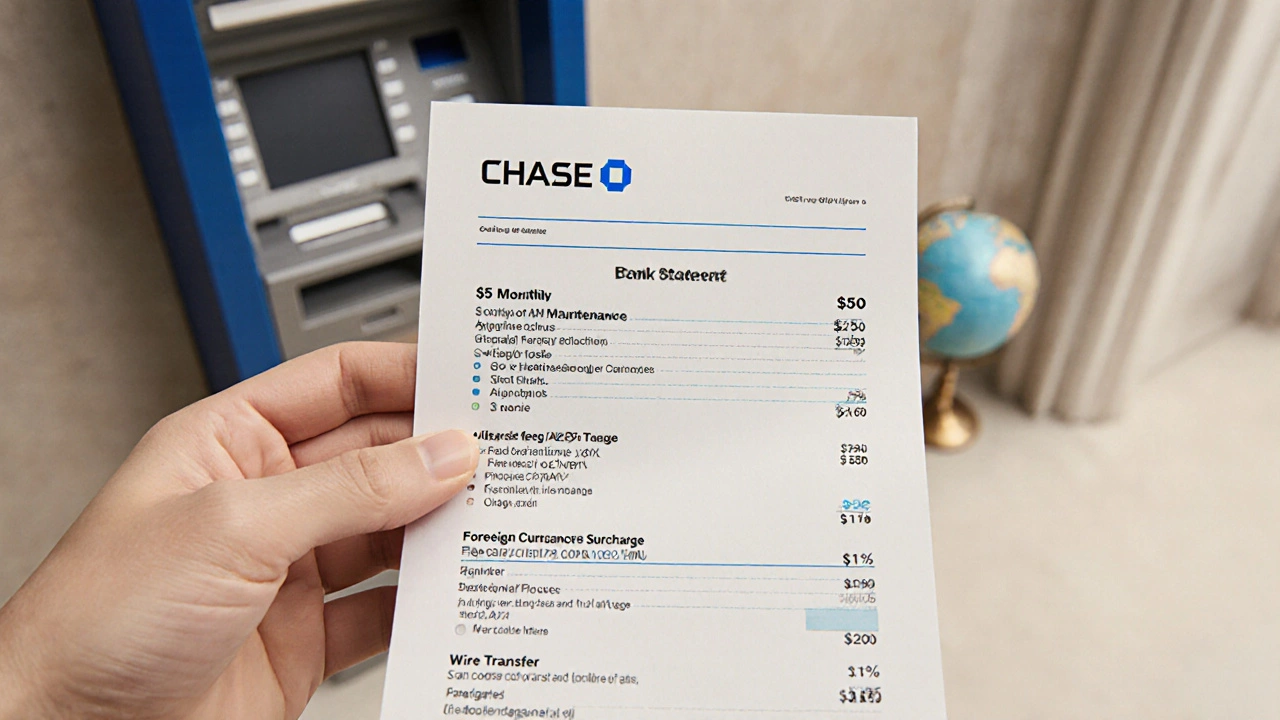

Chase Bank Downsides: Fees, Service, and Hidden Issues Explained

Explore the main downsides of Chase bank, from hidden fees and customer service issues to limited branch access and low savings rates, to help you decide if it fits your needs.

View More

Online Banking India: Should You Make the Switch?

Tired of waiting in queues or rushing to the bank after work? This article breaks down online banking in India and whether it’s the right move for you. We’ll compare online vs offline banking, highlight key features, talk safety, and share tips for smoother digital banking. Read on for real-world insights—no jargon, just straightforward advice.

View More

Best Indian Bank for NRIs: Top Choices for Stress-Free Online Banking

Trying to find the right Indian bank as an NRI can give you a headache, with so many options and fine print to read. This article breaks down which banks offer the smoothest experience for NRIs, pointing out hidden fees, tech features, and must-know rules. You’ll find practical tips on opening accounts from abroad and which banks make sending money or paying bills in India a breeze. We dig into real-world experiences, not just marketing claims. Get the facts you actually need—minus the usual banking jargon.

View More

Which Online Payment Is Safe in India? A No-Nonsense Guide

Figuring out which online payment method is truly safe in India can be confusing. This article breaks down how popular payment options stack up in terms of security features and everyday use. You'll get practical tips on how to spot safe platforms and keep your money protected. From UPI and digital wallets to credit cards, we cover what matters. Make smarter choices the next time you pay online.

View More

How to Set Up Indian Bank Internet Banking

Indian Bank internet banking provides you with the convenience of managing your finances from anywhere. Setting up an account involves a few simple steps that can save you trips to the bank. Familiarize yourself with the process, understand the security features, and experience the ease of online banking. You'll discover tips to maximize the use of your internet banking account efficiently.

View More

Understanding SBI Net Banking Charges: A Complete Guide for 2025

SBI net banking offers a convenient way to manage finances online, but understanding the associated charges is vital for users. These fees vary based on services like NEFT, RTGS, and others. Armed with this information, account holders can make informed financial choices, reduce costs, and enjoy seamless online banking experiences. This guide provides insights, facts, and practical tips to navigate SBI's online banking fees effectively.

View More